DAN COOPER GROUP

In August, home values in the Greater Toronto Area were essentially flat as compared to last year, with an average sales price of $1,082,496, pointing to the remarkable resilience in Toronto’s housing market. However, average prices have declined since interest rates started to rise again this past June. With the Bank of Canada’s announcement on September 6 th to not raise interest rates and the typically slow summer sales period coming to an end, the stage is set for increased buyer competition and upwards pressure on pricing to resume.

August saw a welcome increase in available inventory in the GTA, reaching 15,497 active listings, a notable uptick of 16.5% from the previous month. As inventory regains its equilibrium, sales figures have yet to catch up, with August witnessing a total of 5,294 sales – 33% less than the preceding 10 years of August data.

The average selling price was $1,082,496 as compared to $1,118,374 the previous month. The average price is above last year’s average of $1,079,048. The average number of listing days on the market was 20 as compared to 17 from the previous month. Total active listings were up 16.5% year-over-year, and new listings were up 16.2% year-over-year, from 10,578 in August 2022 to 12,296 in August 2023.

The detached asset class seems impermeable to further impact of interest rate increases, with average prices ending August 3% higher than August 2022 and on par with last month. Detached homes are also selling quickly, on average 19 days.

“More balanced market conditions this summer compared to the tighter spring market resulted in selling prices hovering at last year’s levels and dipping slightly compared to July. As interest rates continued to increase in May, after a pause in the winter and early spring, many buyers have had to adjust their offers in order to qualify for higher monthly payments. Not all sellers have chosen to take lower than expected selling prices, resulting in fewer sales,” said TRREB Chief Market Analyst Jason Mercer.

The GTA real estate market in August 2023 saw less activity, based on the impact of the interest rate increases in June and July, and typical seasonality. Now that Labour Day is over, and for now, the Bank of Canada has decided to hold interest rates, buyers are entering the start of the fall market with more confidence, and more homes to choose from. Whether the change of season and more buyers coming off the sidelines will have a marked impact on pricing remains to be seen, however those buyers looking to make a move would be well served to act now, instead of waiting to see if history repeats itself in the wake of the rate hold.

Now more than ever, having an experienced real estate team by your side is crucial. With over 30 years of experience, the Dan Cooper Group possesses a wealth of knowledge, steadfast work ethic and unparalleled service that delivers results. We are full-service real estate experts and our clients are at the heart of everything we do. Get in touch today!

INSIGHTS

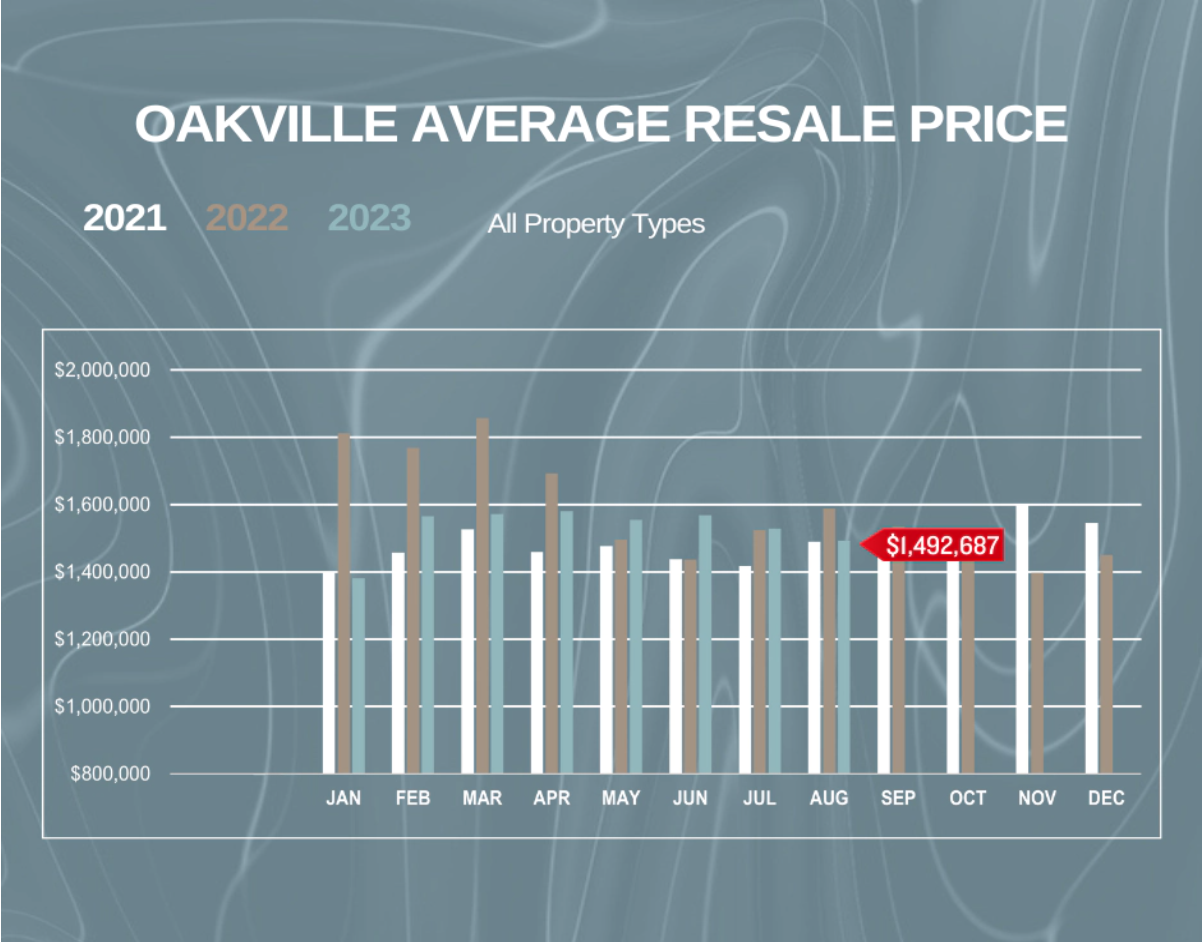

Oakville MARKET INSIGHTS

Market Insights

All property types

AUGUST 2022

AUGUST 2023

167

Homes Sold

+9.58%

183

Homes Sold

$1,587,619

Avg. Resale Price

-5.98%

$1,492,687

Avg. Resale Price

AUGUST 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

88

4

35

13

41

$1,989,978

$1,167,475

$1,265,475

$1,013,915

$824,568

Oakville Average Resale Price

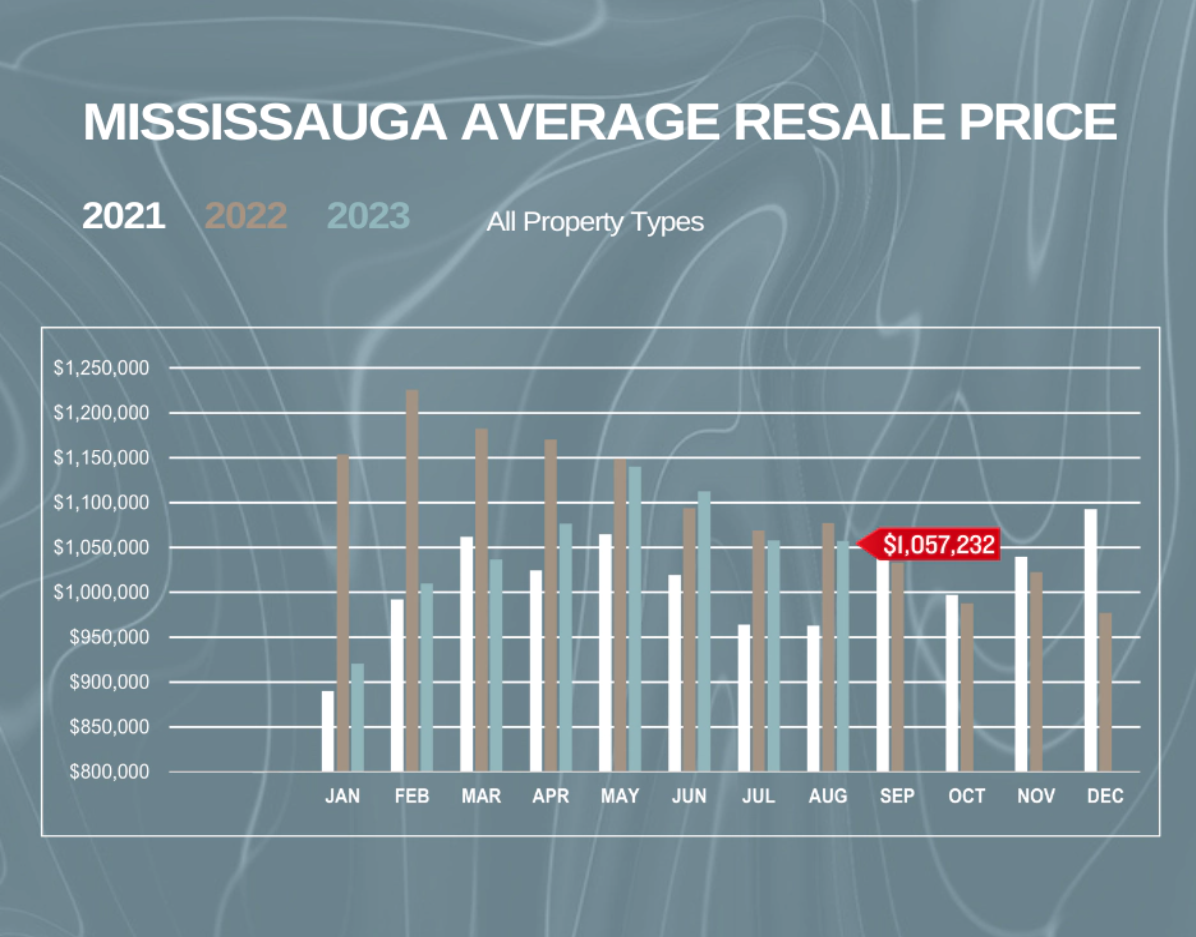

MISSISSAUGA MARKET INSIGHTS

Market Insights

All property types

AUGUST 2022

AUGUST 2023

487

Homes Sold

+3.7%

505

Homes Sold

$1,077,092

Avg. Resale Price

-1.84%

$1,057,232

Avg. Resale Price

AUGUST 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

169

74

20

83

155

$1,563,717

$1,046,247

$956,770

$855,061

$629,894

MISSISSAUGA Average Resale Price

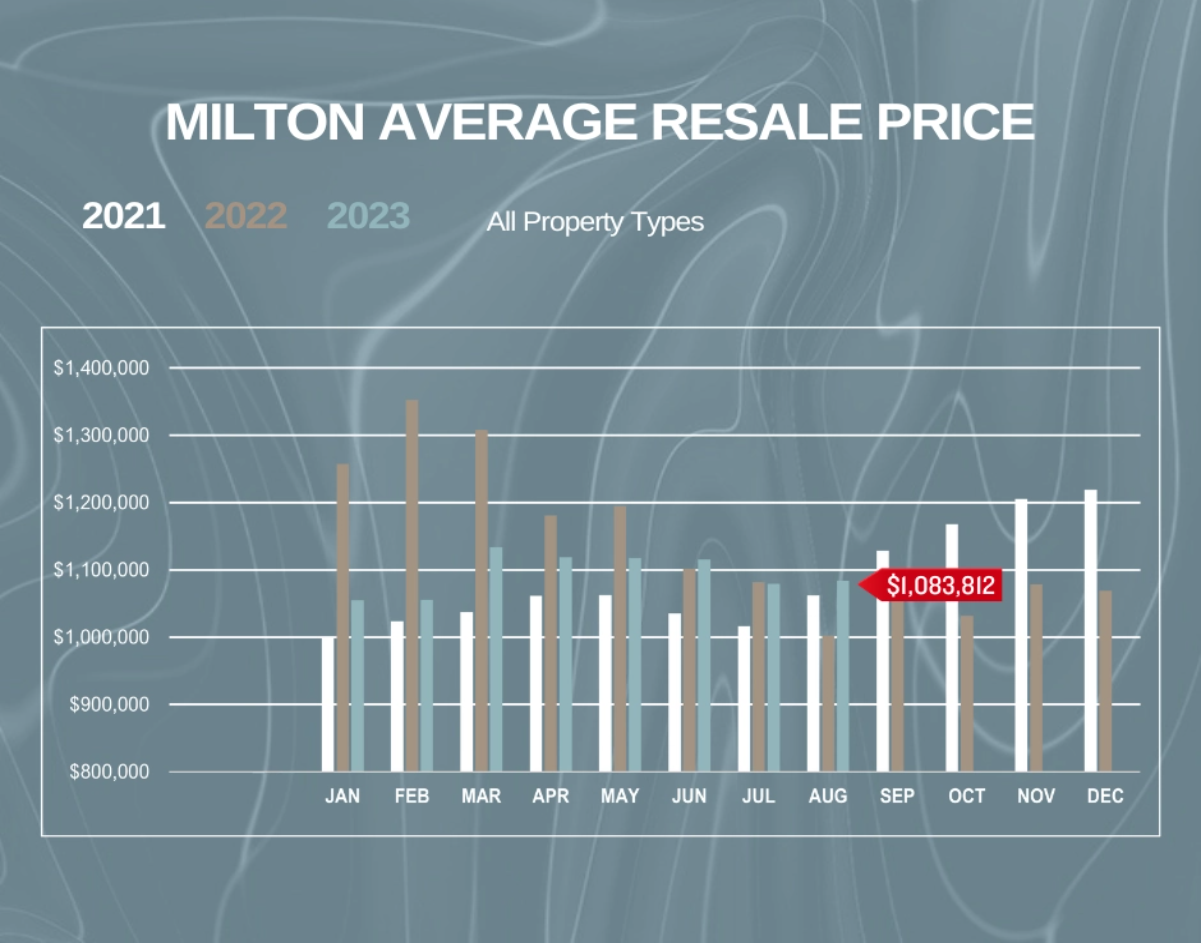

MILTON MARKET INSIGHTS

Market Insights

All property types

AUGUST 2022

AUGUST 2023

153

Homes Sold

-9.15%

139

Homes Sold

$1,002,514

Avg. Resale Price

+8.11%

$1,083,812

Avg. Resale Price

AUGUST 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Apartment

Condo Townhouse

56

16

42

8

16

$1,350,202

$1,053,375

$969,291

$788,613

$635,406

MILTON Average Resale Price

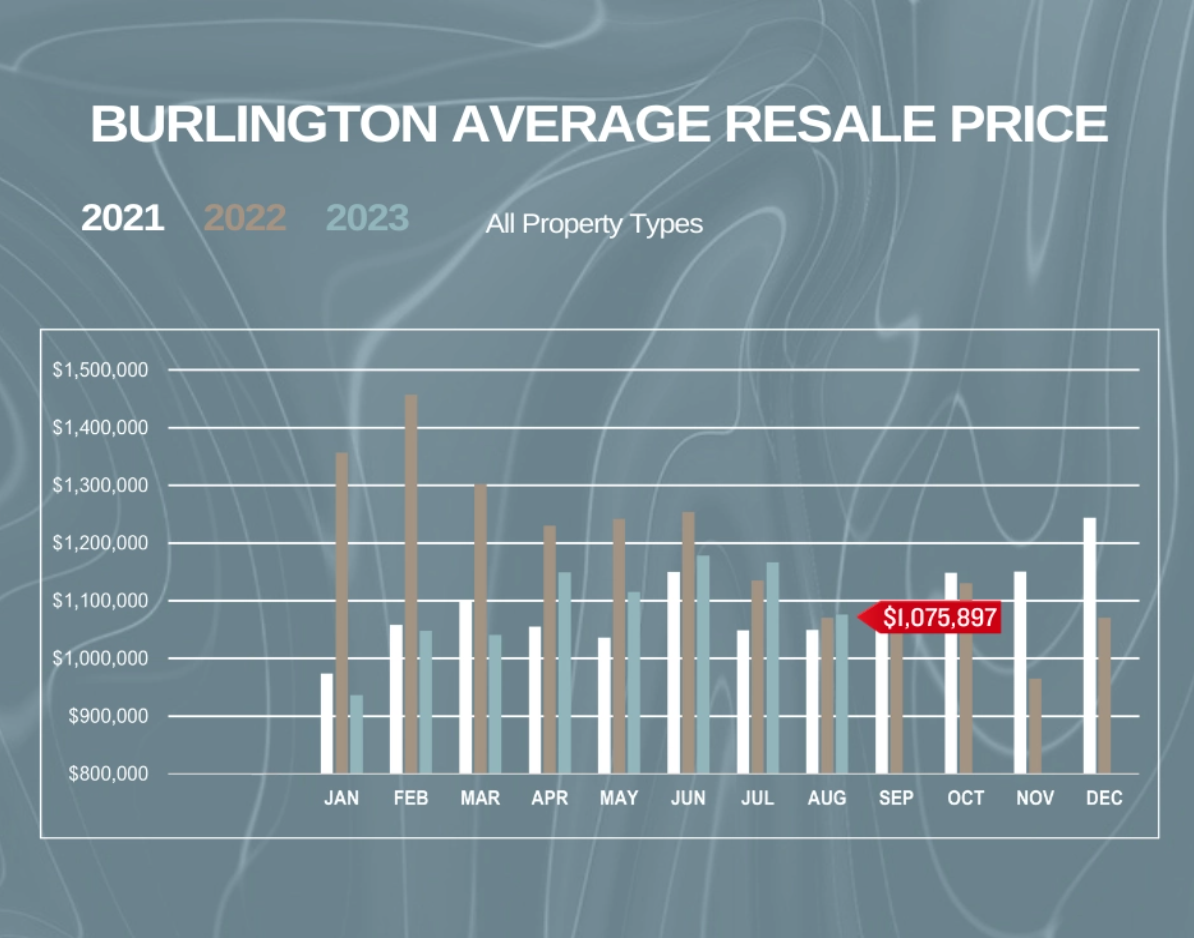

BURLINGTON MARKET INSIGHTS

Market Insights

All property types

AUGUST 2022

AUGUST 2023

211

Homes Sold

-12.32%

185

Homes Sold

$1,070,005

Avg. Resale Price

+0.55%

$1,075,897

Avg. Resale Price

AUGUST 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

84

77

22

32

39

$1,406,473

$965,714

$993,941

$804,411

$668,446

BURLINGTON Average Resale Price