Call Us 905.849.3360

DAN COOPER GROUP

As November concluded, the aggregate value of a GTA home remains at $1,082,179, mirroring last year’s figures. Despite an initial surge in the first half of the year, mid-year interest rate increases led to a temporary dip in home sale prices, marking the second-lowest point for home values in the year.

The surge in inventory appears to have slowed, possibly due to winter seasonality or subdued buyer and seller activity amid heightened borrowing costs. November’s total inventory reached 16,759 active listings, showing a monthly decrease of 2,781 but a year-over-year rise of 4,849 available properties for sale.

As economists commence speculating on potential interest rate cuts, possibly as early as next spring, discussions about when the market might reclaim its previously robust momentum have initiated. This concept is underscored in a recent article featured in the Globe and Mail. “Bay Street prognosticators are currently pricing in a full percentage point of rate cuts next year as Canada flirts with recession. Home prices have much precedent for rising during recessions, by the way. That’s because homebuyer incomes don’t dive all that much and buying power rises as rates drop. But consider this: if average mortgage rates fell merely one percentage point, all it would take to cancel out that nationwide affordability improvement would be a $63,000 bounce in the $656,625 price of an average home.

That kind of gain can happen in two months, as it did last spring. It was only 10 months ago when the Bank of Canada’s premature rate pause inspired homebuying enough to drive prices $74,167 higher in two months and $116,840 (19 per cent) higher in just four months. Part of that rise was because of a change in the types of homes purchased – what economists call the “composition effect” – but the point remains: low rates and low prices attract high demand.”

With stagnate sale prices and anticipated rate cuts, the current market offers buyers potentially the most favourable conditions in years. However, the likelihood of this opportune period lasting for an extended duration appears low.

In the GTA detached segment, monthly losses led to an average sale price of $1,403,500, still $61,652 above the lows of January. For the first time in 2023, inventory declined to 6,834, a 20% decrease from October. While the sales environment remained cautious, completing 1,881 sales marked a 42% decrease from the seasonal average over the preceding ten years.

For homeowners, delaying the search for the perfect deal may have repercussions. The prevailing wisdom suggests the time to buy is when a suitable property is found that fits one’s needs and affordability. With factors like immigration, housing supply constraints, and potential lower interest rates, the current period could be viewed as an opportune time to buy, with less competition compared to what may transpire in 2024.

INSIGHTS

Oakville MARKET INSIGHTS

Market Insights

All property types

NOVEMBER 2022

NOVEMBER 2023

155

Homes Sold

-11.61%

137

Homes Sold

$1,397,718

Avg. Resale Price

+12.47%

$1,572,012

Avg. Resale Price

November 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

77

2

18

15

25

$1,888,364

$1,102,500

$1,261,517

$778,133

$1,335,092

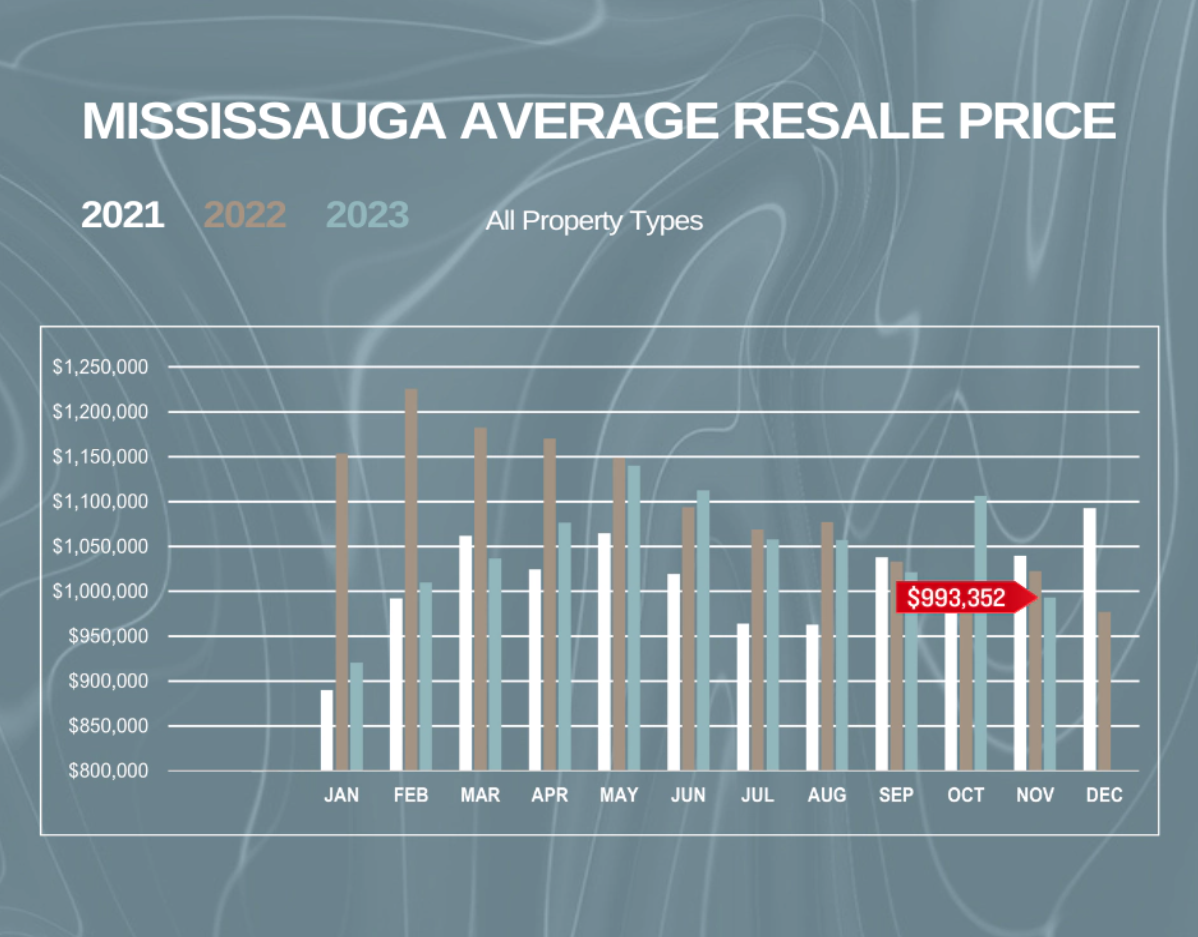

MISSISSAUGA MARKET INSIGHTS

Market Insights

All property types

NOVEMBER 2022

NOVEMBER 2023

409

Homes Sold

-7.82%

377

Homes Sold

$1,022,312

Avg. Resale Price

-2.83%

$993,352

Avg. Resale Price

november 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

126

53

15

77

106

$1,398,829

$1,056,765

$996,667

$764,399

$649,765

MISSISSAUGA Average Resale Price

MILTON MARKET INSIGHTS

Market Insights

All property types

NOVEMBER 2022

NOVEMBER 2023

91

Homes Sold

+8.79%

99

Homes Sold

$1,078,240

Avg. Resale Price

-3.36%

$1,041,949

Avg. Resale Price

November 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Apartment

Condo Townhouse

47

13

23

7

9

$1,288,274

$942,154

$873,135

$671,586

$619,211

MILTON Average Resale Price

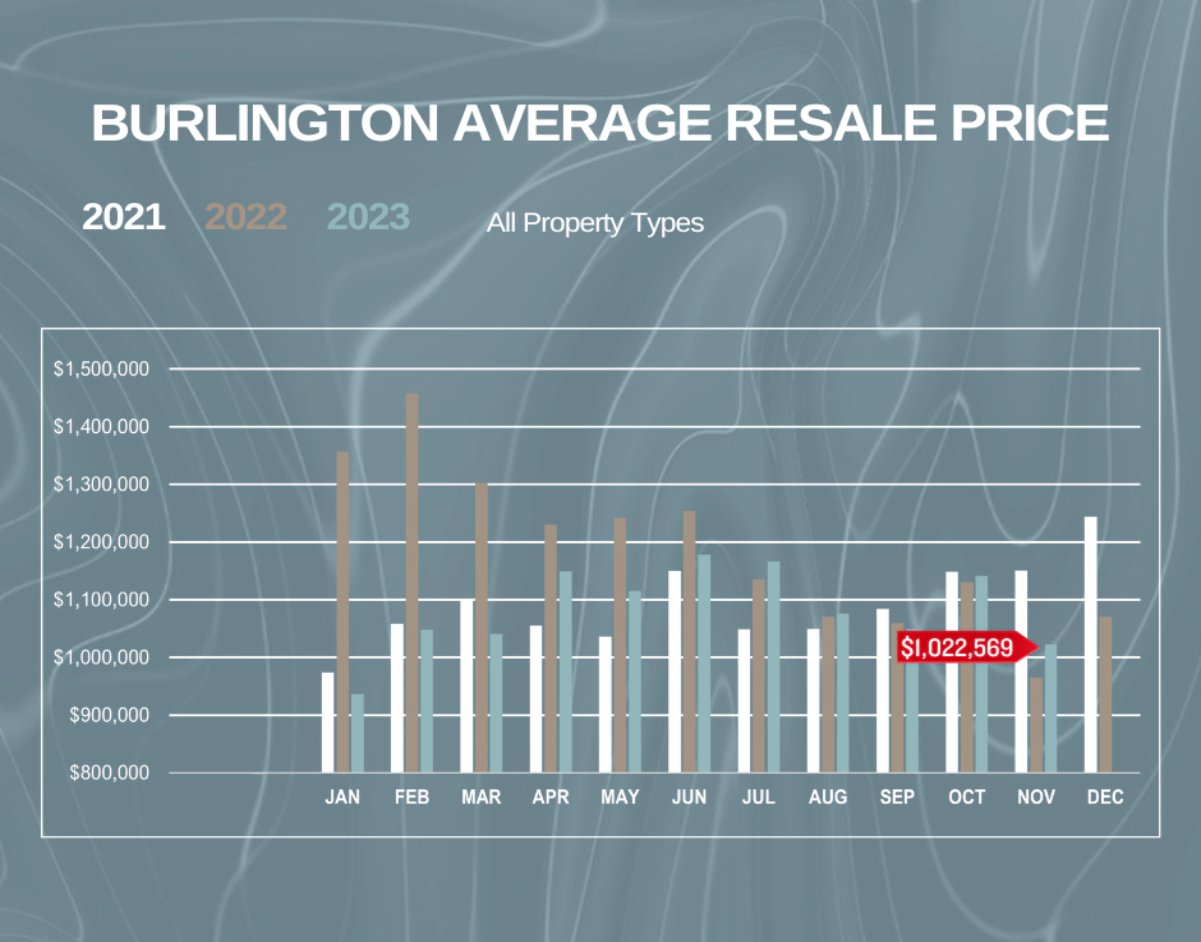

BURLINGTON MARKET INSIGHTS

Market Insights

All property types

NOVEMBER 2022

NOVEMBER 2023

135

Homes Sold

+8.15%

146

Homes Sold

$964,939

Avg. Resale Price

+5.97%

$1,022,569

Avg. Resale Price

november 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

69

4

9

31

27

$1,345,590

$854,000

$885,111

$751,781

$614,389

BURLINGTON Average Resale Price